PART 2: De Minimis: The Loophole That Ate Main Street

De Minimis was designed as a customs shortcut for small shipments under $800. Instead, it has become a Trojan horse: flooding U.S. markets with tariff-free imports, hollowing out domestic producers, and creating a parallel economy where compliance doesn’t matter. SMEs follow the rules; global e-commerce giants route around them.

De Minimis Loophole: How Tariff-Free Imports Undercut U.S. SMEs

The Day the Gate Closed

For years, millions of Americans lived off the bargain bins of global e-commerce. A phone charger for $12. A pair of shoes for $25. They arrived fast, cheap, and duty-free, thanks to a little-known rule called De Minimis.

On August 29, 2025, that gate slammed shut. Section 321—the rule that let packages under $800 skip tariffs and paperwork—was suspended for all countries. Overnight, what had been a hidden subsidy for consumers became the most visible cost on their receipts.

The Shortcut That Became a Superhighway

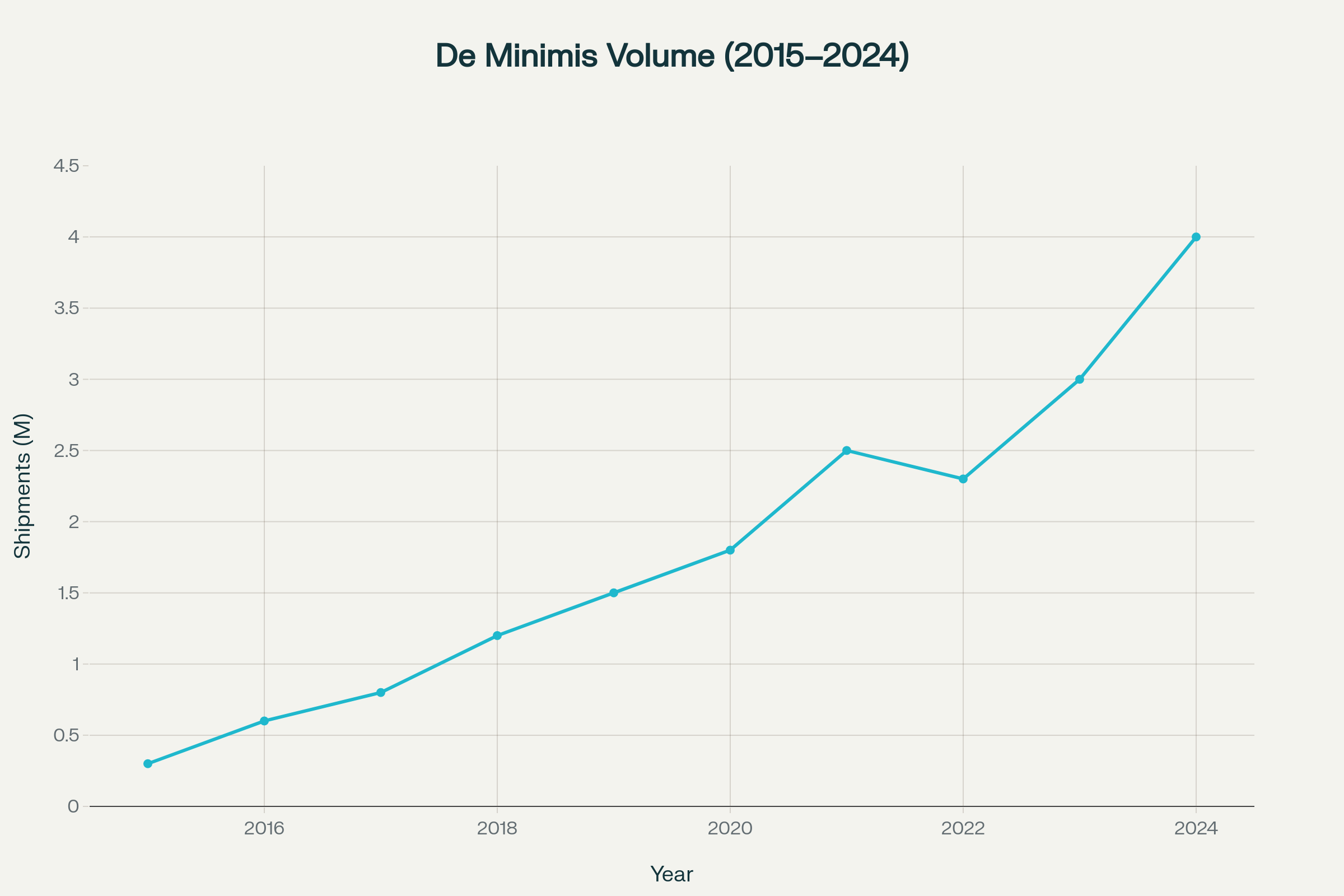

De Minimis rules were meant to simplify customs for low-value shipments. Anything under $800 entering the U.S. slips through duty-free, with no tariffs, minimal paperwork, and little inspection. What started as a niche tool for travelers and small traders is now a multi-billion-dollar backdoor for global e-commerce platforms.

Winners and Losers

Global retailers and logistics giants game the system. Instead of consolidating containers, they atomize shipments: break bulk overseas, then ship directly to U.S. doorsteps in small packages. Every package under the De Minimis threshold avoids tariffs and compliance costs.

Meanwhile, U.S. small and mid-sized enterprises (SMEs) get crushed. They must:

Pay tariffs on imported components.

Track and document every piece of domestic content.

Follow Buy America rules.

Their competitors abroad? They just stamp a label, ship it, and slide past customs.