Caught in the SME Sandwich:

How Buy America, Tariffs, and Cooling Demand Squeeze Manufacturers

SME Sandwich: Domestic Content, Tariffs, Safe Harbor, IRA, and a Slowing Economy - Eric Stevens

Introduction: The Squeeze is Real

Small and mid-sized enterprises (SMEs) are caught in what I call the SME Sandwich: rising compliance thresholds from Domestic Content and Buy America on one side, and a cooling demand environment on the other, with tariffs and stricter enforcement compressing margin in the middle.

The August 2025 jobs report underlines the squeeze: only 22,000 payroll jobs added, unemployment up to 4.3%—the highest since 2021. Translation? End markets are weakening just as costs, paperwork, and penalties pile up.

Individually, each is a challenge. Together, they form a system that squeezes SMEs between regulators above and a cooling market below.

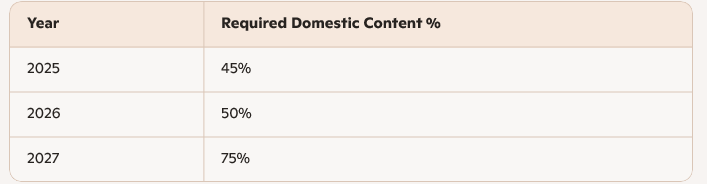

Layer 1: Domestic Content From Patriotism to Punishment

The Build America, Buy America (BABA) rules and Domestic Content (DC) requirements under the Inflation Reduction Act (IRA) were designed to reshore supply chains. On paper, it’s patriotic. In practice, it’s punishing.

• Compliant inputs are scarce outside Foreign Entities of Concern (FEOC).

• Certification is complex, expensive, and unforgiving.

• Large firms can pivot suppliers — SMEs cannot.

And the thresholds are rising fast:

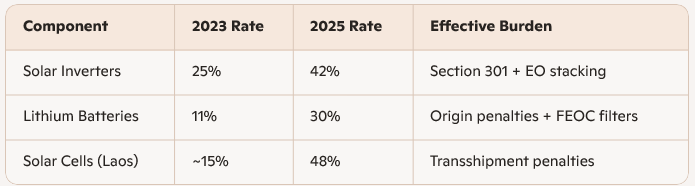

Layer 2: Tariffs: Stacked, Sticky, and Brutal

Forget the headlines. Here’s what SMEs are actually paying:

These aren’t theoretical numbers, they’re what SMEs are seeing on invoices. And unlike large corporations, SMEs can’t hedge with diversified sourcing or legal gymnastics. They absorb the cost directly.

Result: Tariffs remain in force, and SMEs carry the weight, with less margin and fewer options.

Layer 3: Safe Harbor Is Gone, For Everyone

Two “safe harbors” SMEs relied on have collapsed:

Importers

• The “reasonable care” shield is gone.

• HTS/IP code engineering no longer protects against enforcement.

• Transshipment routes (e.g., Vietnam) now trigger audits and penalties.

Energy Developers

• IRS Notice 2025-42 eliminates the 5% spend safe harbor for solar projects over 1.5 MW and all wind.

• Only the Physical Work Test applies: steel in the ground, not just deposits or drawings.

Result: No more half-measures. SMEs must prove compliance physically, not just on paper.

Layer 4: IRA Incentives: Built for Big Players

The IRA offers billions in clean-energy credits. But SMEs face barriers:

• Incentives are gated behind Domestic Content, Prevailing Wage, and FEOC exclusions.

• Credits require large upfront capital — something most SMEs can’t float while waiting on Treasury.

• Large incumbents can absorb the lag; SMEs cannot.

Result: Credits exist, but they’re structurally tilted toward large players. SMEs are left chasing incentives they can’t afford to claim.

Layer 5: The Economy Is Cooling

The August 2025 jobs report confirms it:

• Only 22,000 payroll jobs added.

• Unemployment rose to 4.3 percent, the highest since 2021.

• Manufacturing lost 78,000 jobs year-to-date.

Result: SMEs face higher costs while selling into weaker demand. It’s a squeeze from both ends.

Your CPA Can’t Save You

The era of “file the right forms and you’re safe” is over. Compliance now requires operational proof, not accounting entries.

That means:

• Supplier audits

• Certificates of Origin

• On-site inspections

• Physical documentation of work

A CPA can crunch numbers. They can’t keep you out of a Department of Commerce audit if your supply chain breaks.

The Solar Industry’s Vietnam Conduit Lesson

Solar SMEs learned this the hard way: panels once routed through Vietnam to bypass tariffs now face scrutiny and penalties. What looked like a safe workaround became a liability overnight.

If your compliance strategy relies on loopholes, it’s already obsolete.

Relief Before Regulation: A Smarter Framework

Policymakers must flip the script. SMEs can’t build if they’re suffocated first.

Four steps to relieve pressure:

1. Ease BABA rules on capital assets — let SMEs import the machinery needed to build compliant lines.

2. MFN-style incentives — offer credits for equipment sourced from trusted allies where U.S. capacity is missing. This isn’t just economic strategy — it’s geopolitical foresight. As adversaries increasingly couple their industrial and military capabilities, the U.S. must strengthen supply chains with allies before conflict forces our hand. Our last great industrial mobilization was reactive — triggered by war. Let’s not make the same mistake again.

3. Government-backed financing — low-interest or guaranteed loans for SMEs to acquire capital equipment.

4. SME-specific tax credits — tied to jobs created, ensuring relief reaches smaller operators.

Then apply the squeeze. Build first, regulate second.

The Hard Truth: Mistake or Mass Consolidation?

Right now, SMEs are asked to build, while:

• Their ability to source capital equipment is restricted.

• Their working capital is tied up in tariffs.

• Their customers’ purchasing power erodes from inflation and job loss.

That’s either:

• A policy mistake — sequencing failure, or

• Mass consolidation by design — where only the big players can eat losses until SMEs are gone.

Either way, the result is the same: fewer SMEs, more concentration, less resilience.

Conclusion

The SME Sandwich isn’t a metaphor — it’s the lived reality of 2025. Relief must come before regulation, or America will consolidate industrial capacity into fewer, larger hands. And once that happens, rebuilding a resilient middle tier of industry will be almost impossible.